nanny tax calculator canada

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. You are considered to be an employer when all the following apply to you.

Nanny Tax Calculator - Nanny Pay Calculator - The Nanny Tax Company Nanny Tax Hourly Calculator Enter your employees information and click on the Calculate button at the bottom.

. Find out what expenses are eligible for this deduction who can make a claim and how to calculate and claim it. Fill in the salary How often is it paid. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month.

The Nanny Tax Calculator This calculator will help you understand the total cost of employing a nanny and how much the nanny will take home. Your average tax rate is. One of the best things about being a nanny for a nanny share is that nannies typically make more money.

Same rules apply for a nanny share. Cost Calculator for Nanny Employers. Heres an example to highlight the differences between nanny take home pay employer out of pocket expense and the nannys hourly wage based on gross pay of 600week and net pay of.

Nanny tax and payroll calculator BUDGET ONLY PAYCHECK AND BUDGET Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. It will confirm the deductions you include on your. Nanny Tax Calculator Canada.

A household employer is responsible to remit 765 of their workers. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding. Lines 21999 and 22000 Support payments.

Calculation of net and gross pay taxes CPP and EI amounts. Nanny Tax Specialists HomePay Service Stats and Expert Support for from. Paying your nanny via direct deposit Canada.

Nannytax Payroll Services for UK Employers - Nannytax. To 5 pm assign and supervise the tasks. Nanny tax calculator for a nanny share.

This calculator provides calculations based on the information you provide. This calculator allows you to get an idea of how much you will pay and how much your nanny will take home. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again.

ONLY 50MONTH Nanny Payroll Tax Services Employing you caregiver is easy with HeartPayroll Our payroll services will take care of. Nanny Tax Calculators Nanny Payroll Calculators - The Nanny Tax Company Nanny Tax Calculators Please use one of our two nanny tax calculators to determine the correct wages. Line 21400 Child care expenses.

Establish regular working hours for example 9 am. A household employer is responsible to remit 765 of their workers gross wages in fica taxes. These rates are the default rates for employers in.

To 5 pm assign.

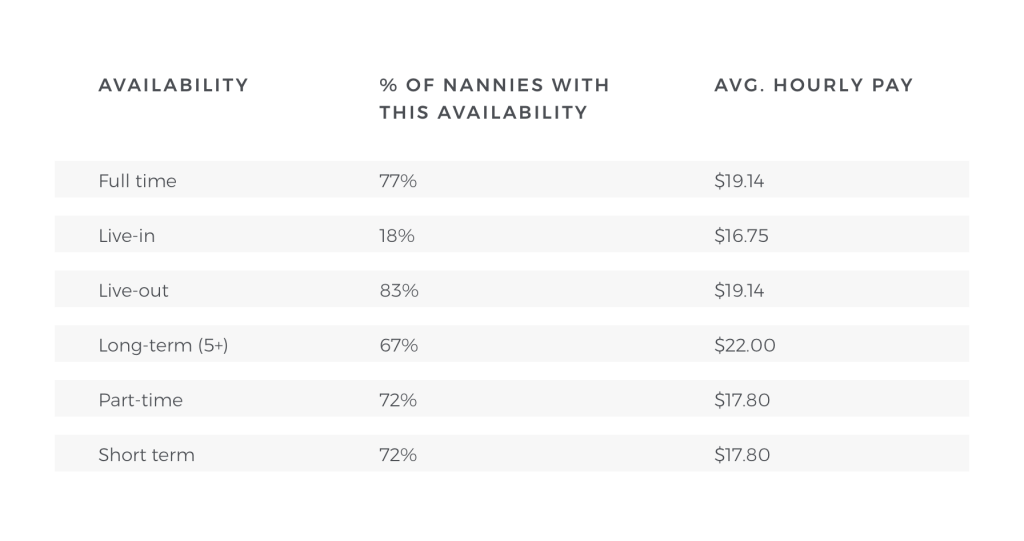

How Much Do I Pay A Nanny Nanny Lane

Provision For Income Tax Definition Formula Calculation Examples

5 Answers You Need When Using A Nanny Tax Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Nannypay 1 Diy Payroll Software How To Pay The Nanny Tax

Nannytax Nannytaxcanada Twitter

Nanny Payroll Service Nannychex

Salary Calculator Canada Salary After Tax

Fillable Pay Stub Pdf Fill Online Printable Fillable Blank Pdffiller

14 Steps To Nanny Tax Compliance For Household Employers

Canadian Payroll Calculator By Paymentevolution

Payroll Remittance And Payout Once Cpp Hits Max R Personalfinancecanada

Tax Preparation And Tax Planning Services In Canada Stratking

Free Self Employed Tax Calculator View Your Potential Tax Obligation Instantly Hurdlr

Provision For Income Tax Definition Formula Calculation Examples