omaha nebraska vehicle sales tax

The Omaha Nebraska general sales tax rate is 55Depending on the zipcode the sales tax rate of Omaha may vary from 55 to 7 Every 2020 combined rates mentioned above are the results of Nebraska state rate 55 the Omaha tax rate 0 to 15. The Omaha sales tax rate is.

Latest Information On Dmv Services Nebraska Department Of Motor Vehicles

Please note that the total amount due from the customer consists only of the tax calculated and collected by the clothing store on this transaction.

. Nebraska has a 55 statewide sales tax rate but also has 295 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 055 on top of the state tax. Find Omaha Tax Records. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

The Nebraska sales tax rate is currently. They include the 25-cent-per-gallon motor vehicle fuels tax typically referred to as the states gas tax and the fluctuating petroleum products gross earnings tax. Nebraska is a state that taxes based on value which is deductible.

Under the pre-1998 system motor vehicles were assigned a value by the Tax Commissioner based on average sales price for vehicles of that make age and model and the local property taxing units of government merely assessed the rate against that value. Registration Year Base Tax Amount 1 2 3 4 5 6 7 8 9 10 11 12 13 14 95 year 1 see below 0 to 3999 2500 25 2250 2000 1750 1500 1275 1050 825 600 375 175 000 2375. - 2000 Total Due.

This means that you save the sales taxes you would otherwise have paid on the 5000 value of your trade-in. Certain Tax Records are considered public record which means they are available. Automotive taxes are high especially in.

Nebraskas motor vehicle tax and fee system was implemented in 1998. Shouldnt be more than a couple hundred. Because this trucks MSRP is about 40000 the first year of motor vehicle tax is 700.

This vehicle owner will also need to buy new license plates and pay Omahas wheel tax. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. He said he expects backers will find.

2020 rates included for use while preparing your income tax deduction. 18 is allocated to the city or village except that. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning Jan.

You can find more tax rates and. If the tax district is not in a city or village 40 is allocated to the county and. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

Wayfair Inc affect Nebraska. Omaha Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Omaha Nebraska. Thats only if you purchased a vehicle and want to register it in Nebraska.

Sales tax cannot be paid on the cost of the motor vehicle at time of registration. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Regardless of whether the vehicle is new or used the buyer will have to pay sales tax and Omaha has a local sales tax in addition to the state.

There must be at least seven students. The Nebraska sales tax rate is currently. In Nebraska the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax.

Per the Nebraska DMV. Brett Lindstrom of Omaha who introduced LB 825 said the fight for tax relief is not over this year. Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax.

For vehicles that are being rented or leased see see taxation of leases and rentals. Did South Dakota v. Rates include state county and city taxes.

In counties containing a city of the metropolitan class 18 is allocated to the county and 22 to the city or village. The state capitol Omaha has a. The County sales tax rate is.

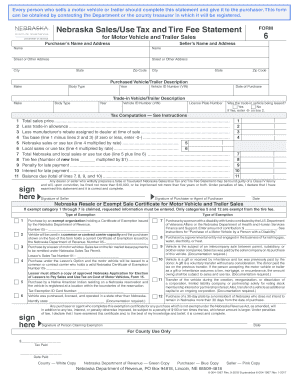

Tax Records include property tax assessments property appraisals and income tax records. The Motor Vehicle Tax is assessed on a vehicle at the time of initial registration and annually thereafter until the vehicle reaches 14 years of age or more. The lessor will select Box 3 in the section titled Nebraska Resale or Exempt Sale Certificate for Motor Vehicle and Trailer Sales on the Form 6 and include their sales tax permit number they use to remit the sales tax collected on each lease payment.

Nebraska has a 55 statewide sales tax rate but also has 295. Your vehicle may be subject to sales tax in the city if there is a total sales tax fee. If for example you intend to purchase a vehicle for 20000 you should pay 7 percent state sales tax.

The sales tax fee is divided into the price before the trade-in or incentives. The latest sales tax rates for cities in Nebraska NE state. The sales tax is still due from the customer even if the deal certificate covers the full price of the article redeemed.

How Do Restaurants Calculate Tax. This is the total of state county and city sales tax rates. The two taxes listed below are deductible but the wheel tax you paid is not.

Before that citizens paid a state property tax levied annually at registration time. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Yours looks to be 14280 owed for motor vehicle tax on a 7 year old car valued at 22000 when purchased.

Search our Omaha Nebraska Sales And Use Tax database and connect with the best Sales And Use Tax Professionals and other Attorney Professionals in Omaha Nebraska.

Motor Vehicles Douglas County Treasurer

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Nebraska Dmv Forms Etags Vehicle Registration Title Services Driven By Technology

Sales Tax On Cars And Vehicles In Nebraska

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Nebraska Sales Tax Small Business Guide Truic

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Support Our Troops License Plates Nebraska Department Of Motor Vehicles

Jeepxchange Iowa Photo Sharing Lose Something

Slash 4x4 Water Action Slash 4x4 Traxxas Slash 4x4 Traxxas Slash

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Contact Us Nebraska Department Of Revenue

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

Pros And Cons Of An Open House In Omaha Nebraska Sell My House Fast Sell My House Open House

Superlative 1927 Sinclair Aviation Gasoline Restored American Visible Gas Pump Model 2487 Barrett Jackson Auction Company Gas Pumps Vintage Gas Pumps Gas

How To Get A Resale Certificate In Nebraska Startingyourbusiness Com

Welcome To Nebraska Nebraska State Signs Life Is Good